Info Jual Property Se Jabodetabek

Navigating the Process of Buying Bank-Owned Properties: A Comprehensive Guide

Navigating the Process of Buying Bank-Owned Properties: A Comprehensive Guide Considering the option to buy bank-owned properties may seem like a lucrative deal, but it’s essential to approach this decision with caution. While these properties may not always be in optimal condition, and the price may not significantly undercut the current market value, understanding the purchasing process is crucial before diving in. In this article, we will delve into the nuances of buying bank-owned properties, shedding light on the distinctions between real estate owned and foreclosure, and providing insights into how banks handle these transactions.

Real Estate Owned vs. Foreclosure

A real estate-owned (REO) property is one that reverts to the mortgage company if it remains unsold at a foreclosure auction. Foreclosure auctions typically set a minimum bid, encompassing the mortgage loan balance, accrued interest, foreclosure expenses, and attorney fees. Bidders must present a bank check for the full bid amount, and if successful, they acquire the property in an ‘as is’ condition. However, challenges may arise, such as occupants still residing on the property and potential additional liens.

As foreclosure auction outcomes often fall short of the amount owed to the bank, unsold properties return to the bank, transitioning into ‘real estate-owned’ status.

Selling Real Estate Owned Properties

Upon reclaiming the property, the bank writes off the mortgage loan and handles necessary eviction procedures, repairs, negotiations with the IRS for tax liens, and settlements of outstanding homeowner’s association amounts. Although banks have varying processes, their overarching goal is to sell the property at the best price. Offers made to the bank typically receive counter-offers, often higher, showcasing efforts to secure the best deal for auditors, shareholders, and investors. Successful negotiations may involve counter-counter-offers, and if accepted, a clause for approval within a specified timeframe.

Pre-Offer Considerations

Before submitting an offer, it’s advisable to gather information from the listing agent through your real estate agent. Inquire about repairs the bank has agreed to undertake and the presence of any special ‘as is’ forms, among other details.

Assessing the True Value:

Despite the allure, a bank-owned property may not always be a bargain. Prior to bidding, conduct thorough research to ensure your proposed price aligns with comparable homes in the area. Factor in potential renovation costs, considering both financial implications and the time required to complete renovations.

Conclusion Navigating the Process of Buying Bank-Owned Properties: A Comprehensive Guide

Buying bank-owned properties presents opportunities and challenges. With a nuanced understanding of the process, potential buyers can navigate this market successfully. By exercising due diligence, seeking professional advice, and understanding the intricacies involved, individuals can make informed decisions when considering the purchase of a bank-owned property.

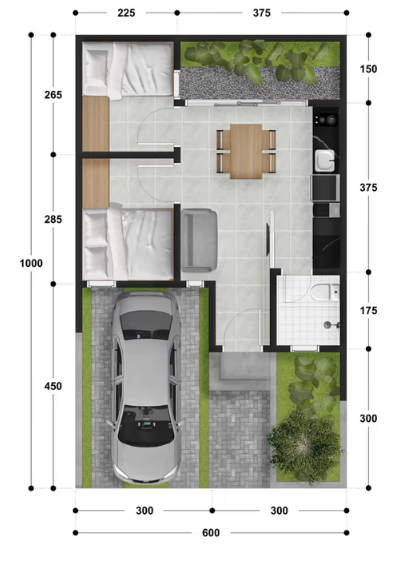

- L.Tanah: 72 m2

- L. Bangunan: 36 m2

- K. Tidur: 2

- K. Mandi: 1

- L.Tanah: 63 m2

- L. Bangunan: 91 m2

- K. Tidur: 3

- K. Mandi: 2

- L.Tanah: 60 m2

- L. Bangunan: 36 m2

- K. Tidur: 2

- K. Mandi: 1

2 komentar

Nice post. I learn something totally new and challenging on sites I stumbleupon every day.

It will always be useful to read articles from other writers and practice

a little something from other web sites. https://velorian.top

thank you very much